It worked before!! Who hasn't heard this? It may be that financial engineering takes advantage of this and turns it into a gaming advantage.

Well, many times we learn from observing some effect in nature that is repeatable. At first, we just use the effect if it's convenient. Then, we study the effect to see why it might be so and how to control it better. That's how science and engineering worked, in the beginning. At some point, we let the computer come between ourselves and our science.

As well, when you have some new product you test it before the public gets involved. For instance, we don't put passengers on a new plane before it has been tested and passed muster.

That is, we put the product through the 'oops with loops in order to reduce the odds for oops.

On the other hand, we have not found such in the dismal sciences of economics and finance. There, we experiment in life (real time), and real people get scarred as a consequence. That is, some of the major players get their pockets filled (year-end festivities are reliant upon this); the majority find themselves worse off. Guess what? Again, it's related to the computer. And, we seem to take it for granted that oops are by nature necessary.

Of course, it would be nice if we only experienced oops that result from our own actions, but, in this case, our pain is either someone else's gain or our oops are consequences of the choices of others. Much argument goes into how we get the playing field leveled or just keep the hands of others out of our pockets.

A case in point is the Auction-Rate Security (ARS) which has become problematic of late for many reasons. A Business Week article says that this market has been working for years; ah, yes, it was working. Well, we could take exception to that fact as on the surface this market might have been well-oiled, but a real close analysis could probably find many warts. That the problematics may have shuffled up to visibility shows several things, such as muddied waters bring up the sediments.

There are several things that we could look at with this type of market. However, one lesson might be that we still need to good old model that is behind bonds, such as the Treasuries.

In fact, the ARS has led to the downfall of the student loan industry. Gosh, that one thing alone is atrocious. Too, do the ARS (and tranche-ing) put lipstick on junky pigs?

There needs to be better accounting on who wins and loses. In terms of the ARS, I would bet that many have lost money over the years (during which the market was working in some views) where loss was taken as a lesson learned (for the individual) about the results of improper decisions and unwarranted risks or was taken as an oops. Yet, we see now that the information involved with this market was not as good as many would hope.

Ah, oops just seem to abound where the Street is concerned. How can one build the future on such shenanigans? America, and others, wake up! We cannot stop the world, but we sure do need a better ontology than that of sharks, etc. (Business Week article).

Remarks:

07/23/2009 -- After the bust and the rebound, toxic assets are still a problem due to tranche realities.

06/07/2009 -- Say what?

01/27/2009 -- Lessons to be learned (as opposed to learnt), including, by necessity, Ponzi.

Modified: 07/23/2009

Saturday, May 31, 2008

Tuesday, May 27, 2008

Creativeness and oops

Of course, that one does 'oops and loops by necessity leads to oops. Our task is to try to control the risks which implies a whole lot of stuff. We can look to both engineering and financial examples to study this further.

But, in looking at finance, does anyone remember that about 18 months ago or so some experts were claiming that the tranche, and its ilk, spread risks such that we would not, ever, have any type of financial meltdown? Was there not some type of meltdown of late? If you don't think so, go talk to the Bear Stearns people, meaning, of course, those who lived and strove for the company and not those cats, of the fat variety, at top.

So, along with tranching, leveraging, and other creative things, we see another bit of activity that was verboten in the 80s, namely "brokered deposits." One quote in the article mentions that we need to manage these things; yet, are we not always faced with the problem described by Minsky, namely froth?

Not to stand in the way of progress, but it seems that a whole lot of financial experimenting has gone on the past couple of decades without much oversight, for several reasons. Of course, as old Alan said, the Fed doesn't have any better forward-looking glasses than do the rest of us. They would better focus on bail-outs, as we have seen in abundance, of late.

Yet, one would expect that we would have some core of mature insight with which to apply our prowess in mathematics and computing.

Remarks:

07/23/2009 -- After the bust and the rebound, toxic assets are still a problem due to tranche realities.

01/27/2009 -- Lessons to be learned (as opposed to learnt), including, by necessity, Ponzi.

11/20/2008 -- Boon and bust, the way of fairy dust.

06/12/2008 -- Turns out to be worse in several senses. It raises uncertainty for the bank since they have other than the traditional relationship with customers. At the same time, gaming types can come in and make trouble for the customers, through various types of malfeasance.

One lesson may be that if you have the money, do your own work in laddering, etc. Ah, but that goes against the grain of having other people do the work.

Modified: 07/23/2009

But, in looking at finance, does anyone remember that about 18 months ago or so some experts were claiming that the tranche, and its ilk, spread risks such that we would not, ever, have any type of financial meltdown? Was there not some type of meltdown of late? If you don't think so, go talk to the Bear Stearns people, meaning, of course, those who lived and strove for the company and not those cats, of the fat variety, at top.

So, along with tranching, leveraging, and other creative things, we see another bit of activity that was verboten in the 80s, namely "brokered deposits." One quote in the article mentions that we need to manage these things; yet, are we not always faced with the problem described by Minsky, namely froth?

Not to stand in the way of progress, but it seems that a whole lot of financial experimenting has gone on the past couple of decades without much oversight, for several reasons. Of course, as old Alan said, the Fed doesn't have any better forward-looking glasses than do the rest of us. They would better focus on bail-outs, as we have seen in abundance, of late.

Yet, one would expect that we would have some core of mature insight with which to apply our prowess in mathematics and computing.

Remarks:

07/23/2009 -- After the bust and the rebound, toxic assets are still a problem due to tranche realities.

01/27/2009 -- Lessons to be learned (as opposed to learnt), including, by necessity, Ponzi.

11/20/2008 -- Boon and bust, the way of fairy dust.

06/12/2008 -- Turns out to be worse in several senses. It raises uncertainty for the bank since they have other than the traditional relationship with customers. At the same time, gaming types can come in and make trouble for the customers, through various types of malfeasance.

One lesson may be that if you have the money, do your own work in laddering, etc. Ah, but that goes against the grain of having other people do the work.

Modified: 07/23/2009

Thursday, May 22, 2008

One year later

7oops7 isn't quite a year old as the first post was almost September of 2007. The precipitating event is one year. As mentioned earlier, the interests are varied, including truth (as in lack of hubris, for one), engineering, finance, and many others.

On the engineering side, we get this from flightblogger, a Happy Birthday.

Now might be a time to review the past year in terms of releases, forums, and all the discussion. Of course, such analysis will take some time.

The anchor point would be the Release one year ago which talked about rolling out (ostensibly to fly) in seven weeks. Then, one can delta forward and backward from that point and look at who knew what or how (too, who is a cheerleader versus an analyst) there was so much confusion (Some seeds, posted 08/31/07; these have not been looked at since November of 2007 but expect an update).

On the finance side, the intent is still to explain that 'gaming' does not sustain an economy and that any scheme that indentures (as in debt to the fat cats) the populace to the nth generation as we see now is not sustainable.

Earlier, Minsky's ideas were used. Also, tie ins between engineering and finance were mentioned, even to the extent of comparing outsourcing to leveraging. We'll get into that more.

Too, we'll need to look at personal finance which lessons apply as well to smaller business, and perhaps broader.

If we look at E_S_T_A_T_E like this brief overview, we can go a long way toward a better framework. We will look more closely at: Earning, Saving, Tithing, Alms giving, Tax paying, Enjoying the fruits.

One might even say, in that order, as we are allowed to do in the USA. That second activity (Saving) is antithetical to what some have seen as a necessary part of the modern economy. "Alms giving" covers a lot of bases including the current encouragements to volunteer. The final action does not imply in any way that debt is required (beyond some reasonable amount - hey, mortgages were real nice before the madness of the past 10 years) nor does it make judgments about extents of spending, such as McMansions, et al, which will be as much controlled by wisdom (which is a growing set - even with the propensity toward greed) as by resources.

Remarks:

04/07/2012 -- Flightblogger ends, as least, Jon's watch. Some issues raised five years ago are still apropos. The context may have changed a little, yet, perhaps now is time to re-address the themes.

Modified: 04/07/2012

On the engineering side, we get this from flightblogger, a Happy Birthday.

Now might be a time to review the past year in terms of releases, forums, and all the discussion. Of course, such analysis will take some time.

The anchor point would be the Release one year ago which talked about rolling out (ostensibly to fly) in seven weeks. Then, one can delta forward and backward from that point and look at who knew what or how (too, who is a cheerleader versus an analyst) there was so much confusion (Some seeds, posted 08/31/07; these have not been looked at since November of 2007 but expect an update).

On the finance side, the intent is still to explain that 'gaming' does not sustain an economy and that any scheme that indentures (as in debt to the fat cats) the populace to the nth generation as we see now is not sustainable.

Earlier, Minsky's ideas were used. Also, tie ins between engineering and finance were mentioned, even to the extent of comparing outsourcing to leveraging. We'll get into that more.

Too, we'll need to look at personal finance which lessons apply as well to smaller business, and perhaps broader.

If we look at E_S_T_A_T_E like this brief overview, we can go a long way toward a better framework. We will look more closely at: Earning, Saving, Tithing, Alms giving, Tax paying, Enjoying the fruits.

One might even say, in that order, as we are allowed to do in the USA. That second activity (Saving) is antithetical to what some have seen as a necessary part of the modern economy. "Alms giving" covers a lot of bases including the current encouragements to volunteer. The final action does not imply in any way that debt is required (beyond some reasonable amount - hey, mortgages were real nice before the madness of the past 10 years) nor does it make judgments about extents of spending, such as McMansions, et al, which will be as much controlled by wisdom (which is a growing set - even with the propensity toward greed) as by resources.

Remarks:

04/07/2012 -- Flightblogger ends, as least, Jon's watch. Some issues raised five years ago are still apropos. The context may have changed a little, yet, perhaps now is time to re-address the themes.

Modified: 04/07/2012

Monday, May 19, 2008

Leveraging and oops

Earlier posts here and on another blog (TE's look at Truth, fiction and finance) suggested that gaming was the basis for a lot of modern finance as people tried to line their pockets, for whatever reason.

This theme will continue along with reviewing all the ways that oops can arise. The Calculated Risk blog provided an overview of leveraging (and tranching - can this be other than sleight-of-hand movement of monies to the bigger pockets, or how do we get something from nothing?) in the context of the recent sub-prime problem. Essentially, leveraging will accentuate movement on either side; if it's positive, then the Streeters (and their others) enjoy big bonuses and maintain their growing distance on the wealth disparity line; if it's negative, then the small guys (usually) lose more relatively than do the bigger pockets.

Except that all this gaming has been the result of Fed foolishness. What happened to the lessons from the 'big crash' with regard to leveraging? So, we have our work cut out for us in regard to the financial shenanigans and related.

On another note, this week Boeing is hosting the world's eyes (both traditional and new, meaning bloggers, of course) in an update of the Dreamliner status. That, no doubt, will spawn off more need to talk about insights, issues, and, especially, the imaginative.

In reference to the Dreamliner program, outsourcing is a type of leverage, especially if expertise is assumed. In terms of that particular program, there were several aspects that will be of continued interest as things unfold, if only for lessons learned.

Remarks:

08/01/2013 -- Ben cannot unwind or taper down; he has too many Doves. We'll have to get back to the king thing (yes, the divine rights of the CEO, new royalty, in other words) and dampening of these types by a new outlook (Magna-Carta'ísh).

03/17/2011 -- Politicos might actually be compounding the issues.

This theme will continue along with reviewing all the ways that oops can arise. The Calculated Risk blog provided an overview of leveraging (and tranching - can this be other than sleight-of-hand movement of monies to the bigger pockets, or how do we get something from nothing?) in the context of the recent sub-prime problem. Essentially, leveraging will accentuate movement on either side; if it's positive, then the Streeters (and their others) enjoy big bonuses and maintain their growing distance on the wealth disparity line; if it's negative, then the small guys (usually) lose more relatively than do the bigger pockets.

Except that all this gaming has been the result of Fed foolishness. What happened to the lessons from the 'big crash' with regard to leveraging? So, we have our work cut out for us in regard to the financial shenanigans and related.

On another note, this week Boeing is hosting the world's eyes (both traditional and new, meaning bloggers, of course) in an update of the Dreamliner status. That, no doubt, will spawn off more need to talk about insights, issues, and, especially, the imaginative.

In reference to the Dreamliner program, outsourcing is a type of leverage, especially if expertise is assumed. In terms of that particular program, there were several aspects that will be of continued interest as things unfold, if only for lessons learned.

Remarks:

08/01/2013 -- Ben cannot unwind or taper down; he has too many Doves. We'll have to get back to the king thing (yes, the divine rights of the CEO, new royalty, in other words) and dampening of these types by a new outlook (Magna-Carta'ísh).

03/17/2011 -- Politicos might actually be compounding the issues.

12/18/2008 -- Leveraging, in and of itself, is not bad.

11/01/2008 -- Recently, Boeing announced having obtained insights from analyzing problems with outsourcing. Well, the company has been a success from applying its lessons learned over a number of decades. Here's one for it to consider: Wichita would have been a marvelous grounding asset - in terms of well-founded knowledge about the 787 status, plus more. Oh, of course, letting it go helped line oodles of pockets which would have not have happened if it had been retained within Boeing.

10/26/2008 -- Leveraging is a fairy dust operation, or as Marx would say, fictitious capital creation is the game. We ought to be looking at what has gone wrong, in more ways than being looked at Paulson, Bernanke, and crew.

Modified: 08/01/2013

11/01/2008 -- Recently, Boeing announced having obtained insights from analyzing problems with outsourcing. Well, the company has been a success from applying its lessons learned over a number of decades. Here's one for it to consider: Wichita would have been a marvelous grounding asset - in terms of well-founded knowledge about the 787 status, plus more. Oh, of course, letting it go helped line oodles of pockets which would have not have happened if it had been retained within Boeing.

10/26/2008 -- Leveraging is a fairy dust operation, or as Marx would say, fictitious capital creation is the game. We ought to be looking at what has gone wrong, in more ways than being looked at Paulson, Bernanke, and crew.

Modified: 08/01/2013

Monday, May 12, 2008

Poll completion 5

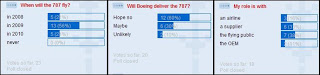

23 voters showed up for the 5th poll with most being of the flying public (38% of 18) or suppliers (31% of 18).

Most saw that first flight would be after 2008 (77% of 23) and that the 787 would be delivered (90% of 20)

Support bet2give: 787 will test flight in Q2 2008

Prior polls: First, second, third, fourth.

Remarks:

01/20/2013 -- Change link for bet2give.

12/30/2008 -- See, will the 787 test flight in Q2 2009?

05/13/2008 -- It's not a scientific poll, yet the numbers might be interesting.

- In September of 2007, most in the poll said that first flight would be after mid-2008

- In October of 2007, most in the poll said that delivery would be in 2009

- In November of 2007, most in the poll said that delivery would be in 2009

- In January of 2008, most in the poll said that first flight would be after October of 2008 and that delivery would be after October of 2009

- In April of 2008, most in the poll said that first flight would be in 2009

Modified: 01/20/2013

Subscribe to:

Posts (Atom)