I never saw any of the these movies. And, I am starting to remember the mania at the first movie release (Star Wars). At the time, it seemed awful silly. Now, we're decades past, and it still seems so.

But, then, some made oodles of money. And, a whole lot of people have been entertained.

Soon after the original mania, a Defense Initiative got a "Star Wars" nickname. Remember that? Lots of folks were weighing on both sides of that argument. Then, the later '80s and early '90s sort of pushed that whole theme to the background.

And, now, we find that some naive views on security were way off base. The internet, for one thing, is a mess. Then, we can start to list ... (must we?). Let's just say, the cloud is muddy (no manna there).

When the first movie came out (we were all younger), I had just gone through a couple of years reading a bunch of science fiction. Of course, Asimov was high on the list of favorites. There are more.

But, I never went to a movie if I had read the book after doing it once. Like Paul Simon says, cannot beat the sweet little imagination. Hear that, Hollywood? Their quandary is that things have to rush to the bottom (real fast) in order to keep the titillation up.

Remarks: Modified: 12/17/2015

12/17/2015 --

Thursday, December 17, 2015

Sunday, November 15, 2015

Quora II

Earlier, I mentioned Quora and getting involved (7-oops-7, fed-aerated, also truth engineering). Quora seems to have no end to subjects and questions. In many cases, the responses are world class.

The image is from the FEDaerated blog and from a post on Quants. I did several posts here one the subject (Quants via 7oops7).

Yesterday, I got a comment in regard to my use of "Dismal Science" with regard to Economics (shocking truth?). Of course, I had my usage (very valid extension of the meanings). And, I see that there has been a lot of discussion on the web. So, we'll be picking that up here for a theme.

While looking at the commentator's Profile, I noticed that there were tens of these related to finance, including some on financial engineering (my earlier posts). Blogs are static affairs. One writes and can look at counts. Sometimes, there are comments. But, it's one-sided. Quora is more full in that several opinions can be expressed. That is, opinion meaning a viewpoint based upon assumptions and differences in understanding.

So, expect that there will be more here that ties these two paradigms.

Remarks: Modified: 11/16/2015

11/16/2015 -- Added link to this Question: What are the most shocking truths about macro economics at the global level?

|

| Quants |

Yesterday, I got a comment in regard to my use of "Dismal Science" with regard to Economics (shocking truth?). Of course, I had my usage (very valid extension of the meanings). And, I see that there has been a lot of discussion on the web. So, we'll be picking that up here for a theme.

While looking at the commentator's Profile, I noticed that there were tens of these related to finance, including some on financial engineering (my earlier posts). Blogs are static affairs. One writes and can look at counts. Sometimes, there are comments. But, it's one-sided. Quora is more full in that several opinions can be expressed. That is, opinion meaning a viewpoint based upon assumptions and differences in understanding.

So, expect that there will be more here that ties these two paradigms.

Remarks: Modified: 11/16/2015

11/16/2015 -- Added link to this Question: What are the most shocking truths about macro economics at the global level?

Tuesday, September 29, 2015

Quora

Since late July, I have been using Quora. It is a means for questions to be posted. Then, people answer. See related posts on Truth Engineering.

One answer pertinent to this blog is this: How-could-Googles-new-logo-be-only-305-bytes-while-its-old-logo-is-14-000-bytes/answer/John-M-Switlik

Also, this answer is the most read, to date.

Remarks: Modified: 11/15/2015

11/15/2015 -- Good look at the downturn (my response).

One answer pertinent to this blog is this: How-could-Googles-new-logo-be-only-305-bytes-while-its-old-logo-is-14-000-bytes/answer/John-M-Switlik

Also, this answer is the most read, to date.

Remarks: Modified: 11/15/2015

11/15/2015 -- Good look at the downturn (my response).

Tuesday, August 18, 2015

30-day view

From time to time, it's nice to look at what is being read and then to see where the originating source is. For us, a summary is fine. Those who commercialize want to track every little click.

On the right menu bar, we have the all-time most-popular posts listed. These are almost in a fixed-point stage. The 30-day view moves around a little more, topically.

Three things stood out. For one, Gab Standard (updated view) has been on the 30-day list, for some time. The original post was 2008 right about the time of the down turn. Since then, the topic has become even more compelling. Just consider, how productive is all of the hoopla concerning whether the FED will raise the rate? What is missing in all of the verbiage being thrown around is that savers are still being flayed (and, will continue to be for some time, evidently).

Then, Reasonable effectiveness is there since I have been writing more about quasi-empiricism under the truth engineering framework. I asked the question on Quora which got an interesting response from bots.

Of course, we want to talk a bit more about unknowns (thrown about by our old friend, Scott).

Remarks: Modified: 08/18/2015

08/18/2015 --

On the right menu bar, we have the all-time most-popular posts listed. These are almost in a fixed-point stage. The 30-day view moves around a little more, topically.

|

| 30-day reads |

Three things stood out. For one, Gab Standard (updated view) has been on the 30-day list, for some time. The original post was 2008 right about the time of the down turn. Since then, the topic has become even more compelling. Just consider, how productive is all of the hoopla concerning whether the FED will raise the rate? What is missing in all of the verbiage being thrown around is that savers are still being flayed (and, will continue to be for some time, evidently).

Then, Reasonable effectiveness is there since I have been writing more about quasi-empiricism under the truth engineering framework. I asked the question on Quora which got an interesting response from bots.

Of course, we want to talk a bit more about unknowns (thrown about by our old friend, Scott).

Remarks: Modified: 08/18/2015

08/18/2015 --

Monday, July 27, 2015

Look backs

This is a different connotation of "back" from that used in the last post (where we say that finance is more of a culprit than engineering). In this case, we are considering the eight years of blogging that have gone into this and the companion blog (truth engineering had its first post on July 24, 2007 - Truth, can it be engineered?). The first post here was in August the same year.

Both of these blogs are contemporaneous views on a subject with discussion (and opinion) thrown it. As such, they offer several threads. The one that has prime focus deals with finance and its issues (spawning off the Fedaerated blog). It turns out that the finance thread's cycle will be reset again, as we go through experiencing the after effects of choices made the past few years. One key issue is the flim-flam market view that has been so much touted and which is so exploited (because, those in control can and chose to do so). We will be going into this whole thing in more detail.

---

Another blog, Thomas Gardner of Salem, started in September of 2010. A blog of a similar nature just had a Blogoversary (six years).

---

This blog deals with oops ('oops, hoops, etc.). As such, the range of discourse is fairly broad. One key, though, is computational assists and their influences. At the beginning, the topics dealt with engineering (design, manufacture, etc.). Then, finance offered up itself (thanks) and will continue to be of focus. Why? For one, another poster boy popped up the other day (WSJ on 78-year old).

Remarks: Modified: 07/27/2015

07/27/2015 -- On CS and IQ (Quora).

Both of these blogs are contemporaneous views on a subject with discussion (and opinion) thrown it. As such, they offer several threads. The one that has prime focus deals with finance and its issues (spawning off the Fedaerated blog). It turns out that the finance thread's cycle will be reset again, as we go through experiencing the after effects of choices made the past few years. One key issue is the flim-flam market view that has been so much touted and which is so exploited (because, those in control can and chose to do so). We will be going into this whole thing in more detail.

---

Another blog, Thomas Gardner of Salem, started in September of 2010. A blog of a similar nature just had a Blogoversary (six years).

---

This blog deals with oops ('oops, hoops, etc.). As such, the range of discourse is fairly broad. One key, though, is computational assists and their influences. At the beginning, the topics dealt with engineering (design, manufacture, etc.). Then, finance offered up itself (thanks) and will continue to be of focus. Why? For one, another poster boy popped up the other day (WSJ on 78-year old).

Remarks: Modified: 07/27/2015

07/27/2015 -- On CS and IQ (Quora).

Thursday, June 25, 2015

Not back IV

This is about Jim M, indirectly.

So, who is he? Well, our first post mentioning the guy was in 2009 (he did get Scott out of the way). There were a few others.

Essentially, BA let (made?) Mulally go to Ford. He is now retired. Jim M was their choice. At the time, the finance guy was running things after the hefty guy got booted for philandering.

Ethics issues? Did Jim M help?

So, now, a 30-year veteran is coming into the position to replace Jim M. Forbes said that the 787 (each of them) will have a $30M tax (the overrun spread over the number to be built). Too, it suggested that Jim M could have worked with the employees.

Jim M came from a place that made notes that stick on pads, etc. He came into an industry where there are proprietary benefits from having employees that know what they are doing.

We have not really paid attention for a few years now. There is so much to look at. Is there time? Actually, is there interest? Yes and yes. But, the review be done thoroughly.

Well, happy retirement (I understand that he'll be involved with the Board).

Remarks: Modified: 06/25/2015

06/25/2015 --

So, who is he? Well, our first post mentioning the guy was in 2009 (he did get Scott out of the way). There were a few others.

Essentially, BA let (made?) Mulally go to Ford. He is now retired. Jim M was their choice. At the time, the finance guy was running things after the hefty guy got booted for philandering.

Ethics issues? Did Jim M help?

So, now, a 30-year veteran is coming into the position to replace Jim M. Forbes said that the 787 (each of them) will have a $30M tax (the overrun spread over the number to be built). Too, it suggested that Jim M could have worked with the employees.

Jim M came from a place that made notes that stick on pads, etc. He came into an industry where there are proprietary benefits from having employees that know what they are doing.

We have not really paid attention for a few years now. There is so much to look at. Is there time? Actually, is there interest? Yes and yes. But, the review be done thoroughly.

Well, happy retirement (I understand that he'll be involved with the Board).

Remarks: Modified: 06/25/2015

06/25/2015 --

Thursday, June 11, 2015

Rework

This blog has accumulated posts since July of 2007. It has a companion blog which started earlier: truth engineering (tru'eng). Through the eight (almost) years, tru'eng allowed a more general look at the problems covered in this blog.

For both blogs, the initial focus was on product and process, from early stages all the way through (to release and support and further). At the time that this blog started, some unifying schemes were already underway; these have come a long way.

Being that the blogger has been doing advanced computational work for decades, it is nice to see the culmination of a whole lot of work even though youngsters seem to, now, benefit more through massive influxes of money into their pockets. Yet, all of that, plus the adulation of the masses, does not remove some basic problems which we will again attempt to re-introduce into the discussion.

You see, oops are all around. I have a litany (several decades in existence) that will come to fore. You might consider that its existence has fostered the appreciation of "near zero" (we'll get back to that). The reason that some oops are allowed is that the little people provide a very large buffer. Too, some things on the litany (yes) relate to means established to provide "teflon" to certain types of folks. ... But, one can say that the world has always worked thus.

So, oops? Well, from an engineering focus, we turned to finance as idiots, and their impact, seemed to abound everywhere. The blog had the original focus for two months. Then, things started to fall apart (actually, the awareness of such, since the issues were there - not seen by the experts, such as King Alan): November 2007 post. And, would you believe(?), the engineers got their act together (after marketing quit bothering them); the financial wackos are worse now.

---

So, let's take one example. Since the tru'eng rework addresses undecidability, we ought to go back and look at an instance where both of these blogs had a post on the same topic.

There are many examples (two shown above) where a re-look is apropos. How this review gets accomplished is an open issue, right now.

Remarks: Modified: 06/12/2015

06/11/2015 --

For both blogs, the initial focus was on product and process, from early stages all the way through (to release and support and further). At the time that this blog started, some unifying schemes were already underway; these have come a long way.

Being that the blogger has been doing advanced computational work for decades, it is nice to see the culmination of a whole lot of work even though youngsters seem to, now, benefit more through massive influxes of money into their pockets. Yet, all of that, plus the adulation of the masses, does not remove some basic problems which we will again attempt to re-introduce into the discussion.

You see, oops are all around. I have a litany (several decades in existence) that will come to fore. You might consider that its existence has fostered the appreciation of "near zero" (we'll get back to that). The reason that some oops are allowed is that the little people provide a very large buffer. Too, some things on the litany (yes) relate to means established to provide "teflon" to certain types of folks. ... But, one can say that the world has always worked thus.

So, oops? Well, from an engineering focus, we turned to finance as idiots, and their impact, seemed to abound everywhere. The blog had the original focus for two months. Then, things started to fall apart (actually, the awareness of such, since the issues were there - not seen by the experts, such as King Alan): November 2007 post. And, would you believe(?), the engineers got their act together (after marketing quit bothering them); the financial wackos are worse now.

---

So, let's take one example. Since the tru'eng rework addresses undecidability, we ought to go back and look at an instance where both of these blogs had a post on the same topic.

- ...7'oops7 - Reasonable effectiveness - good engineering practices can produce results without considering the issues raised here; yet, suppression and oppression of the importance of these issues (to be discussed further) does come back to bite - usually when hubris is at some unbearable height.

- ... Truth engineering - Unreasonable effectiveness - Unreasonable comes about since there are all of these things that we can do, and that we can use to do, which come about from ways and means that are not known (whence?, etc.). Basically, we do, learn, redo, ... while cycling through knowns and unknowns (with this very large reality in which we find ourselves responding (as it wants). At one time, there was discussion of unknown-unknowns (BTW, this was a subject handled jointly, to boot), almost in a frivolous manner. Yet, if you look at the tru'eng post, we think that number-fying conquers most (if not all).

There are many examples (two shown above) where a re-look is apropos. How this review gets accomplished is an open issue, right now.

Remarks: Modified: 06/12/2015

06/11/2015 --

Monday, June 8, 2015

Winning at all costs

It was ten years ago, recently, that there were a couple of things happening that affected a whole lot of people in a small town in the middle of the country. In the scope of things, and looking back, it was not a big deal. However, to those involved, it cut deep many ways.

Now, a few months later (as in, a small number of years) we had the downturn. You see, the events alluded to above were part of the mania that was all about. Oh yes, golden sacks came into town, with other players, such as a private equity firm from Canada, and jostled around the workers at a plant owned by an esteemed company which is no longer present, anywhere, closer than a two-hour drive, or so. But, for the jostled, the company had been their life; in fact, the history was long, in decades.

So, you want specifics. Well, we'll get there. This is an overview.

First, let's look at what happened. On the weekend following Memorial Day, the traditional start of summer (I know, of much more significance than that), there was a "DHL or mail" day. A bifurcation was taking place (perhaps, like, in some cases, that well-known thing of haves and have-nots). So, by this event, everyone was to learn their status with regard to the jostling.

It was clever, I will admit (yes, Nigel - kudos to you). People who were being folded into a new company were sent letters with an offer. Disclosure: I got one. Yes, mail, which is protected by Federal laws (is private, etc.). Those of the other type were visited by a DHL truck. Imagine, if you would, that you are working in your yard on an early summer day (or relaxing by the pool) and that a truck drives up. By the time this was happening, everyone in town knew of the plan. Yes, right there in front of the whole neighborhood, you were delivered your "dear john" letter telling you bye-bye; the letter said, we'll let you know when you can come to get your stuff (in the meantime, we don't want to see your face).

You see, some DHL'ers were completely taken by surprise. Those of the white-collar jobs lost contact information (and a lot more) developed over the years (oh you say, pity, pity -- I say, contrast this to the coddled crew of Google and other workplaces of many who do not know what work is).

So, we had the event of the weekend. By the end of the weekend, everyone knew their fate. Many were crushed. But, it is worse than that. Those who did not take the offer that they got in the mail (a whole bunch of other stories) were handled by means other than what one would expect in an American workplace (this much I know from personal experience (long list of unethical machinations) and desire to research it further in regard to others, at some point - 9 Years ago - from 2014).

Starting the next week, people were sorted out as to acceptance or not; and, the work began on the realizing the goal of the managers which was to create something that would pay big (yes, did they ever have big eyes - thinking of the payout). The main jefe retired recently; he had some take beyond what he would have accumulated with the company, but his windfall was minuscule compared, again, to something like Google. They did get an IPO, but the stock was under water for a long time. Being, again, at the precipice, it'll be interesting to watch the unfolding, again.

---

Again, this happened during the mania which we have looked at here an elsewhere. But, guess what? Today, I drove by the parking lot of a large plant which was mostly vacant. Those who did the deal above tried the same with an old and reputable firm (albeit that the thing had been sold to a conglomerate by the family). And, they loaded on so much debt (paying themselves thereby) that the thing folded; workers were left go; ...; another litany could follow. Yes, within a few miles of each other we can see the American Dream from all sides (another set of posts await).

---

Today, I saw that someone had read an old post, from 2008. By that time, things were getting to the bottom. Ben was frantic. ... All of this is commented on in posts in this blog. This collection (and posts from the associated blogs) will be used for a review and analysis. As in, we have sufficiently accumulated the potential for another downturn.

The 2008 post? Yes, it dealt with oops of a financial nature (not necessary, by any means).

But, too, recently, I saw that a long-pending lawsuit related to the above set of events might be settled. For $90M. After how much effort by lawyers and the parties concerned? Care to venture an amount?

But, too, recently, I saw that a long-pending lawsuit related to the above set of events might be settled. For $90M. After how much effort by lawyers and the parties concerned? Care to venture an amount?

As a final thing, let's look at this from the viewpoint of those jostled (in case you have not made the connection, it's the workers; no, golden sacks, and their ilk, come out smelling like a rose - ah, so much to discuss with regard to whether there can be more rationally based methods applied). The issue dealt with workers who were unlucky enough to fall within an unfortunate timeframe. Yes, they lost a lot (see what was written in 2014, for an example). With this deal, they won't get much, somewhere around $40K per worker. The company saves a lot, on the other hand.

Why? Well, excluding, for the moment, the legal aspects (after all, to know the whole deal we would have to be privy to ten years of legal wangling), this is an example of what I have been labeling "near zero" (which may sound link Nash-ism, but is not). Those who take cause misery all around for the benefit of the few; those who give are multitude (oh, yes, peasants, essentially, according to the few).

Remarks: Modified: 06/08/2015

06/08/2015 --

Now, a few months later (as in, a small number of years) we had the downturn. You see, the events alluded to above were part of the mania that was all about. Oh yes, golden sacks came into town, with other players, such as a private equity firm from Canada, and jostled around the workers at a plant owned by an esteemed company which is no longer present, anywhere, closer than a two-hour drive, or so. But, for the jostled, the company had been their life; in fact, the history was long, in decades.

So, you want specifics. Well, we'll get there. This is an overview.

First, let's look at what happened. On the weekend following Memorial Day, the traditional start of summer (I know, of much more significance than that), there was a "DHL or mail" day. A bifurcation was taking place (perhaps, like, in some cases, that well-known thing of haves and have-nots). So, by this event, everyone was to learn their status with regard to the jostling.

It was clever, I will admit (yes, Nigel - kudos to you). People who were being folded into a new company were sent letters with an offer. Disclosure: I got one. Yes, mail, which is protected by Federal laws (is private, etc.). Those of the other type were visited by a DHL truck. Imagine, if you would, that you are working in your yard on an early summer day (or relaxing by the pool) and that a truck drives up. By the time this was happening, everyone in town knew of the plan. Yes, right there in front of the whole neighborhood, you were delivered your "dear john" letter telling you bye-bye; the letter said, we'll let you know when you can come to get your stuff (in the meantime, we don't want to see your face).

You see, some DHL'ers were completely taken by surprise. Those of the white-collar jobs lost contact information (and a lot more) developed over the years (oh you say, pity, pity -- I say, contrast this to the coddled crew of Google and other workplaces of many who do not know what work is).

So, we had the event of the weekend. By the end of the weekend, everyone knew their fate. Many were crushed. But, it is worse than that. Those who did not take the offer that they got in the mail (a whole bunch of other stories) were handled by means other than what one would expect in an American workplace (this much I know from personal experience (long list of unethical machinations) and desire to research it further in regard to others, at some point - 9 Years ago - from 2014).

Starting the next week, people were sorted out as to acceptance or not; and, the work began on the realizing the goal of the managers which was to create something that would pay big (yes, did they ever have big eyes - thinking of the payout). The main jefe retired recently; he had some take beyond what he would have accumulated with the company, but his windfall was minuscule compared, again, to something like Google. They did get an IPO, but the stock was under water for a long time. Being, again, at the precipice, it'll be interesting to watch the unfolding, again.

---

Again, this happened during the mania which we have looked at here an elsewhere. But, guess what? Today, I drove by the parking lot of a large plant which was mostly vacant. Those who did the deal above tried the same with an old and reputable firm (albeit that the thing had been sold to a conglomerate by the family). And, they loaded on so much debt (paying themselves thereby) that the thing folded; workers were left go; ...; another litany could follow. Yes, within a few miles of each other we can see the American Dream from all sides (another set of posts await).

---

Today, I saw that someone had read an old post, from 2008. By that time, things were getting to the bottom. Ben was frantic. ... All of this is commented on in posts in this blog. This collection (and posts from the associated blogs) will be used for a review and analysis. As in, we have sufficiently accumulated the potential for another downturn.

The 2008 post? Yes, it dealt with oops of a financial nature (not necessary, by any means).

But, too, recently, I saw that a long-pending lawsuit related to the above set of events might be settled. For $90M. After how much effort by lawyers and the parties concerned? Care to venture an amount?

But, too, recently, I saw that a long-pending lawsuit related to the above set of events might be settled. For $90M. After how much effort by lawyers and the parties concerned? Care to venture an amount?As a final thing, let's look at this from the viewpoint of those jostled (in case you have not made the connection, it's the workers; no, golden sacks, and their ilk, come out smelling like a rose - ah, so much to discuss with regard to whether there can be more rationally based methods applied). The issue dealt with workers who were unlucky enough to fall within an unfortunate timeframe. Yes, they lost a lot (see what was written in 2014, for an example). With this deal, they won't get much, somewhere around $40K per worker. The company saves a lot, on the other hand.

Why? Well, excluding, for the moment, the legal aspects (after all, to know the whole deal we would have to be privy to ten years of legal wangling), this is an example of what I have been labeling "near zero" (which may sound link Nash-ism, but is not). Those who take cause misery all around for the benefit of the few; those who give are multitude (oh, yes, peasants, essentially, according to the few).

Remarks: Modified: 06/08/2015

06/08/2015 --

Thursday, May 14, 2015

Talking to the choir

Or, something of that order.

I guess you all knew that Ben started blogging. Also, one aspect of our interest was the financial gaming that is taken for reality, as if there were a strong foundation for the idiocy and its useful (yes, to fill the pockets of those running the game and of those who have an inside track). It has been two weeks since Ben's last post; his posts, to me, seemed like academic papers. Not what one expects from a blog, typically. ... Ah, Ben, what do you feel down in your bones (and nothing too cultural here)? I know, you claim that you did not throw the oldsters under the bus.

In any case, Steve's view resonates, from a distance. I don't know how closely we would match up; say, Steve, know what I mean by near-zero? Well, what you are talking about here is a good example (money managers run away with the cream, leaving very low-fat remains).

Dire, indeed.

Remarks: Modified: 05/14/2015

05/14/2015 -- And so, after the post and content has been digested (does not imply absence of forethought), then epilog bits come to fore. The first half of that letter is what resonates. Then, Ben&Steve talking "incredible returns" in the stock market grates (harshly). For one, the thing, as run now, is a ca-pital-sino and very much can be characterized by near-zero (both terms have links in the text). Too, though, is the whole thing of the magical multiplier (wild expansion of value), of returns mainly for the early birds (connivers), and of enormous grabs (by some) that desires serious analysis (again, foreclosure - not in any way now profiting, nor in the past profited, from the gaming - whose main thing is to impoverish the masses). ... There will be a change in tone, thanks to Canfield (yes, he of the chicken soup thing). --- So, the diatribe series will stand as an example: so-called constructive looks, No. 1, No. 2, No. 3.

|

| This image is almost like a blot test. Ah, how many types of reactions. |

In any case, Steve's view resonates, from a distance. I don't know how closely we would match up; say, Steve, know what I mean by near-zero? Well, what you are talking about here is a good example (money managers run away with the cream, leaving very low-fat remains).

Dire, indeed.

Remarks: Modified: 05/14/2015

05/14/2015 -- And so, after the post and content has been digested (does not imply absence of forethought), then epilog bits come to fore. The first half of that letter is what resonates. Then, Ben&Steve talking "incredible returns" in the stock market grates (harshly). For one, the thing, as run now, is a ca-pital-sino and very much can be characterized by near-zero (both terms have links in the text). Too, though, is the whole thing of the magical multiplier (wild expansion of value), of returns mainly for the early birds (connivers), and of enormous grabs (by some) that desires serious analysis (again, foreclosure - not in any way now profiting, nor in the past profited, from the gaming - whose main thing is to impoverish the masses). ... There will be a change in tone, thanks to Canfield (yes, he of the chicken soup thing). --- So, the diatribe series will stand as an example: so-called constructive looks, No. 1, No. 2, No. 3.

Thursday, April 9, 2015

FB and metaphors

Note (11/18/2022) -- FB, now Meta, is following predictable tracks. We'll be observing and commenting more closely, from outside the monolith, of course. See Remarks, below. Also, the posts that get references in this work will be cleaned up (normal little typos, stale pointers, etc.).

---

In fact, on FB, this week, I put a comment after reading this article - Humans in Computing: Growing Responsibilities for Researchers which was published by the ACM (acm.org).

Comment (4/8/15 at 8:39 on FB): Like we saw with Pavlov's subjects, ought we to suppose that some feeds may cause more salivation than do others? Much to discuss here: FB/cloud as metaphor (very crude approximation of the real thing which modernity has tried to squelch, but cannot), for one. We know what causes politicos to salivate: money passed under the nose.

Yes, all sorts of metaphors apply. But, then, FB, like all modern computing paradigms, is running willy-nilly, casting flowers about (hippy like - but with money involved - looking to gain some) while entrapping mankind into a very insidious snare (wake up, people).

So, we will get on with this topic once more. After all, it's five years late. You know what? Who would have thought that Ben/Janet would still be screwing the elderly, flaying the savers, and such. In the time frame of that metaphor post, we were looking for some improvement. What happened was that more idiocy ran amok. But, later on that.

For now, I have to tell about what I ran across yesterday. First, though, a couple of words about my FB usage. Essentially, it's a large index (albeit, full of features) into which I push notes, links to posts, and such. Too, I belong to a few groups (usual affair of watching for events, happenings, announcements, and the like). But, I do not hang on FB. I get in, and out, several times a day. That is, I log in, do what is needed, then log out (there is a reason behind this that will be explained, at some point).

Yesterday, during one of my many, mini-sessions, there was a pop up of the chat window with a friend as the originator (at least, that was what would be assumed from the ID). The attached image is a trace of the conversation. Now, it shows an hour for the elapsed time. I was doing other things, including leaving FB and coming back. Too, I had to assimilate the message, ponder the meaning, etc. several times.

The chat tone was: hey, I just heard from an agent who has been authorized to give grants of $150K. You can see that I was asking for more information trying to be understanding. As the interchange went on, flags were flying. For instance, there was a requirement to send in money which is a classic sign of a scam.

But, how does one not step on a friend's toe? Say, what if the friend had already sent in money. Actually, what if it had been legit (who knows with all of the activity that one sees on-line, nowadays, including financial efforts).

Aside: The biggest pain are know-it-alls (even if they are correct a time or two) who walk in their hubristic cloud as if they are superior in every way over the little guy, especially if they are computer types who are ignoring issues related to the shaky underpinnings. If you read, and follow, my exposition on economic basics, you will see that we ought to see that the economy really belongs to the humans who are in it (not to the capitalistic/aristocratic/... classes who have been overlords for so long - ah, so much to discuss).

Anyway, it turns out that the friend's account had been hacked. I just happened to be picked by whomever (more below) to get contacted. I didn't get a chance to see if it were a bot or fiend (meaning human). Look at some of my queries. Too, FB took away the content once some supervisor (meaning system-watching system) tagged the conversation as spam. So, too, when I reported the chat as spam, the thing disappeared.

However, I did get this trace (ought to have snapped earlier, but I can recreate the bot/fiend part of the dialog). Here is the image (FB Friend [other] and FB User[me]).

|

| Chat with bot or fiend |

If I had known then what I know now, I would have pursued the conversation further (Turing'ly).

In any case, it was troubling for several reasons. If the friend's account had not been hacked, then it would imply that predators were loose on FB. Well, since last night, I have looked at the issue, and, sure enough, spam is a concern.

Guess what? I have been on FB since 2008, and this was my first experience with this sort of thing. Of course, the practice that I mentioned earlier came about because I observed side-effects of using FB (can explain, as required) that were problematic. So, once I got my process in place, FB (and my computer) has been nicely behaved.

Of course, I will categorically say that I do not (do not expect to) buy via FB. Nor, do I look at their ads. People who watch me notice that I don't get distracted by the frilly going-ons that screen presentation has devolved (yes, yes) to these days.

---

Well, enough. Here is a re-look, 2012 time frame.

Remarks: Modified: 11/18/2022

04/09/2015 -- So, this event happened during a feed'ing frenzy related to a new group that had grown to 600+ users in just 2 days. Lots of feeds going on.

05/14/2015 -- Related post.

07/22/2015 -- I have been getting calls that bring Turing to mind. There have been three so far. In the first, it sounded so real, that I reacted as if to a human. On the second, the message was the same. Hello, I am such-and-such. Did I catch you at a good time? ... I usually respond by saying, depends upon whom I am talking to or depends on why you called. But, as I was giving my response, there was small blip on the line, and the message went further. It was like some was reading from a script and not really listening. In both of the early calls, I hung up. On the third call, I just listened, After the message, there was a pause. Too, something was listening for a response. But, I said nothing and just let it loop through the logic. It kept going with the explanation for the call and what the caller could do for me. ... Now, for the next few calls, ought I experiment with phrases to see if the response changes? Most likely it will. Either I would learn something or they would quit (hopefully, the latter happens before the former).

11/17/2022 -- See Quora, Psychether for a discussion that will use these concepts as point-in-time observations.

Friday, March 27, 2015

There yet?? II

Carrying forward the reporting being done in the There yet?? post. Photo from Nov. 2014. Now, almost 210K.

|

| Taken by phone camera. Not bad. |

Disclosure: Wikipedia log, Kelley Blue Book (image at bottom). One large factor is that the miles are 80% highway with little hot dogging (who can resist moving up a mountain with alacrity when there are multiple lanes to use?). The original brakes are little worn.

Remarks: Modified: 03/27/2015

Tuesday, March 10, 2015

Assorted

Today is a slump day (markets down over 1% by noon). Yesterday was a seeding day. Both of these effects are influenced by the magical multiple which feeds the illusion of liquidity.

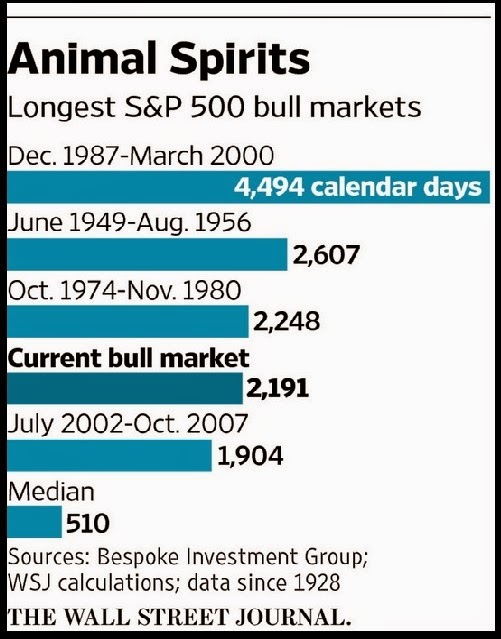

The Monday WSJ can be always full of insightful comments. The close of last week allows a breather and a better look (review). So, then, one gets the real deal prior to the week's openings. This past Monday was no exception. There are three articles that will be looked at here. Each has an image that is worthy of note.

Now, where else to talk about this continuing set of problems? Oops are all around; albeit, those who suffer are, for the most part, not party to the choices that affect them. ... But, we will get there. For now, see the notes about our research at Fedaerated (in particular, Browning's article).

Here, we will show an image from each of the above with comments.

Remarks: Modified: 03/10/2015

The Monday WSJ can be always full of insightful comments. The close of last week allows a breather and a better look (review). So, then, one gets the real deal prior to the week's openings. This past Monday was no exception. There are three articles that will be looked at here. Each has an image that is worthy of note.

- Stock Bulls Run on Shaky Ground -- Spencer Jakab -- iterates the theme of expanding multiples (we'll get back to Minsky on this) and cautions that there will be an implosion, eventually.

- How to Survive a Bear Market -- E.S. Browning -- provides a nice (squished via log view) look at the mania since the 1940. Why mania? Lots of reasons but see the next buller.

- Prepare for New Money-Fund Rules -- Kirsten Grind -- there is a little image (Ahh, remember 5%?) that I will augment showing how Ben/Janet have been thrashing the savers (taking us behind the woodshed - plus, flaying us to within an inch of skin) these past few years. So what? Well, conservative/stable approaches are more rational than not (somehow the brains [best and brightest - so called] have made life to be a joke, essentially game based without proper consideration of the issues - yes, unbalanced view abound).

Now, where else to talk about this continuing set of problems? Oops are all around; albeit, those who suffer are, for the most part, not party to the choices that affect them. ... But, we will get there. For now, see the notes about our research at Fedaerated (in particular, Browning's article).

Here, we will show an image from each of the above with comments.

|

| Browning's article: See Fedaerated (link in above text). |

Remarks: Modified: 03/10/2015

03/10/2015 --

Monday, February 16, 2015

Minsky quoted in the WSJ

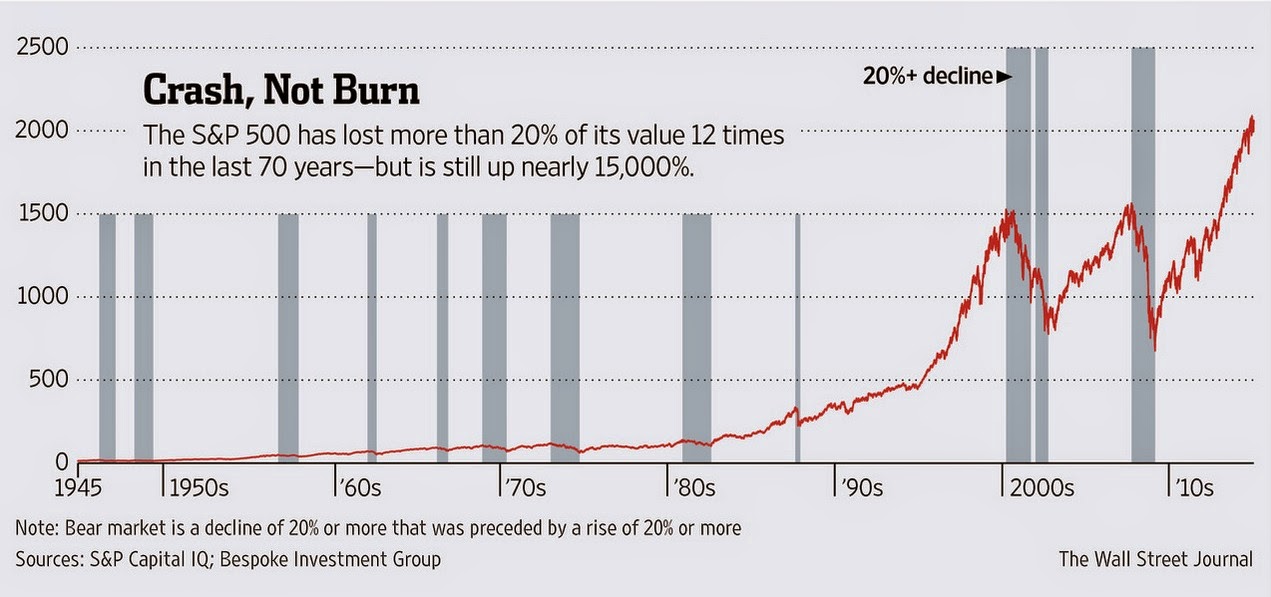

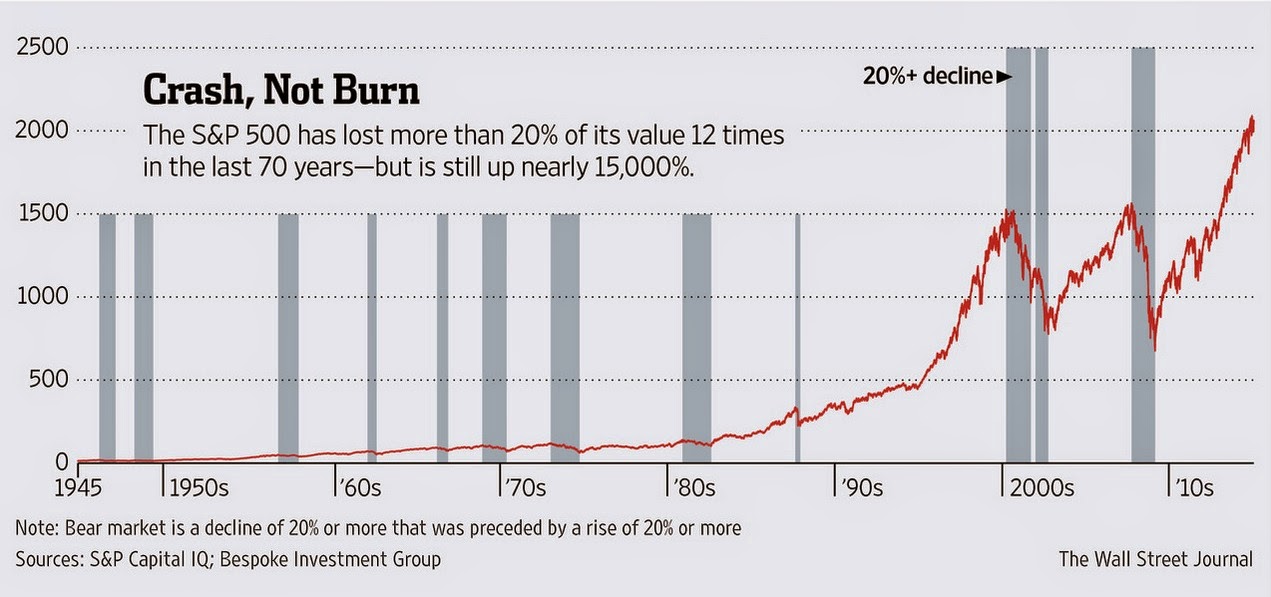

Saturday, 02/14/15: Why Bear Markets are Inevitable (Morgan Housel).

We have mentioned Minsky a lot, over the years (he has his own category). It's nice to see him referred to, albeit in a Saturday issue which implies reflective views rather than something more operational (that is, until we have the downturn with the accompanying pain).

At the FEDaerated blog, we're doing a series (albeit slowly) on why the markets crash so fast.

Look at the graph (below) that Housel touts. Now, be aware of several things. For one, the current level is supported by largess on the part of the Fed and other central bankers. Then, recall that those higher levels are supported by rules that keep runaway falls from happening (though they did not catch the not-so-long-ago falls due to technical glitches [it is said, but who knows?] which caused some to experience losses - not golden sacks who was let off the hook). Then, remember that we now have computational influences of an unknown nature, as well as the existence of dark pools, and such, muddying the whole framework. ... We will, in time, go on and on.

We appreciate the Hyman Minsky mention as it will allow another relook: A Theory of Systemic Fragility. ... We intend to show that his sequence (hedge, speculative, ponzi [made-off?]) has been perturbed in ways never consider by Prof Minsky. Namely, computation (dark pools, et al) have exacerbated the problem. My put: flim-flam use of mathematics (easily done since the algorithmic tools allow this) has run amok (it's time for a review).

Remarks: Modified: 02/16/2015

We have mentioned Minsky a lot, over the years (he has his own category). It's nice to see him referred to, albeit in a Saturday issue which implies reflective views rather than something more operational (that is, until we have the downturn with the accompanying pain).

At the FEDaerated blog, we're doing a series (albeit slowly) on why the markets crash so fast.

Look at the graph (below) that Housel touts. Now, be aware of several things. For one, the current level is supported by largess on the part of the Fed and other central bankers. Then, recall that those higher levels are supported by rules that keep runaway falls from happening (though they did not catch the not-so-long-ago falls due to technical glitches [it is said, but who knows?] which caused some to experience losses - not golden sacks who was let off the hook). Then, remember that we now have computational influences of an unknown nature, as well as the existence of dark pools, and such, muddying the whole framework. ... We will, in time, go on and on.

|

| Yes, inflated market |

Remarks: Modified: 02/16/2015

Wednesday, January 14, 2015

Gab standard II

The original post was dated June 10, 2008. Gosh, over 6 1/2 years ago. Since then, financial discussions have mostly been under the context of FEDaerated (fiat money) in a continuing fashion as problem abound. And, we all of rational mind are waiting for the bubble to burst. The FED's roles dealing with fiat money have exacerbated the problems as seen from the reality of the street (as in, Main and others not called Wall).

One problem is that there is a chimera that comes about, in part, due to charades. Yes, Wall likes to make sure that the game is in their favor. And, a good example of that type of thing could be the dark pools and like ilk. There are others (and, if we could lift the skirt or open the kimono, we would see many, many more).

One problem is that there is a chimera that comes about, in part, due to charades. Yes, Wall likes to make sure that the game is in their favor. And, a good example of that type of thing could be the dark pools and like ilk. There are others (and, if we could lift the skirt or open the kimono, we would see many, many more).

---

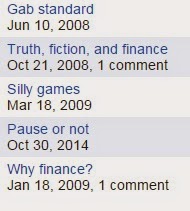

I noticed, today, that some of the older posts are being read - see the image - which could indicate several things. All of these were from back before the spurt of mania that came from the FED's largess. And, that spurt mainly is equity oriented; savers have been flayed to an inch of their lives (how much longer can they hold on?).

Be that as it may, no one seems to be pushing a normative view. Why? So, we intend to do that. One approach will be to pick up these old posts and bring them up to date. That, of course, will take work and time. But, then, we have already said that we're under no time constraint.

---

The original post looked at the concept of stable money. You know, figuring that out is not easy. In fact, some approach, such as bitcoin, might be the solution. However, it would be a generally adopted scheme and not privately owned (ah, lots to discuss there).

Now, for a real gas, one of the WSJ articles was talking about the weak dollar. What we know has happened, of late, is that the dollar is strengthening, perhaps too much. One thing for sure is that manipulations like done with the FED's type of operations are oriented to the benefit of the country doing the machinations. Others have to react as best they can.

What kind of strategy is that (asking normatively, okay?) for a sustainable economy?

---

Before quitting, notice that another of the posts is "Silly games" and refer to the dark pools above. Then, "Why finance?" mentions leeches; yes, still very much apropos.

Remarks: Modified: 01/15/2015

One problem is that there is a chimera that comes about, in part, due to charades. Yes, Wall likes to make sure that the game is in their favor. And, a good example of that type of thing could be the dark pools and like ilk. There are others (and, if we could lift the skirt or open the kimono, we would see many, many more).

One problem is that there is a chimera that comes about, in part, due to charades. Yes, Wall likes to make sure that the game is in their favor. And, a good example of that type of thing could be the dark pools and like ilk. There are others (and, if we could lift the skirt or open the kimono, we would see many, many more).---

I noticed, today, that some of the older posts are being read - see the image - which could indicate several things. All of these were from back before the spurt of mania that came from the FED's largess. And, that spurt mainly is equity oriented; savers have been flayed to an inch of their lives (how much longer can they hold on?).

Be that as it may, no one seems to be pushing a normative view. Why? So, we intend to do that. One approach will be to pick up these old posts and bring them up to date. That, of course, will take work and time. But, then, we have already said that we're under no time constraint.

---

The original post looked at the concept of stable money. You know, figuring that out is not easy. In fact, some approach, such as bitcoin, might be the solution. However, it would be a generally adopted scheme and not privately owned (ah, lots to discuss there).

Now, for a real gas, one of the WSJ articles was talking about the weak dollar. What we know has happened, of late, is that the dollar is strengthening, perhaps too much. One thing for sure is that manipulations like done with the FED's type of operations are oriented to the benefit of the country doing the machinations. Others have to react as best they can.

What kind of strategy is that (asking normatively, okay?) for a sustainable economy?

---

Before quitting, notice that another of the posts is "Silly games" and refer to the dark pools above. Then, "Why finance?" mentions leeches; yes, still very much apropos.

Remarks: Modified: 01/15/2015

01/15/2015 --

Subscribe to:

Posts (Atom)